Remote Control

Clinical Trial Supplies Market Report 2024-2034 - Rising Demand For Biologics Propelling Growth Of Cold Chain Distribution Supplies

Company Logo

Dublin, March 29, 2024 (GLOBE NEWSWIRE) -- The "Clinical Trial Supplies Market Report 2024-2034" report has been added to ResearchAndMarkets.Com's offering.

World revenue for the Clinical Trial Supplies Market is forecast to surpass US$ 4.10 billion in 2024, with strong revenue growth through to 2034.

Opportunities in Emerging Markets Projected to Boost Industry Growth

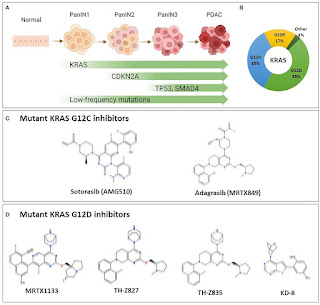

Clinical trials are increasingly moving to developing economies like China, India, and Japan in the Asia Pacific region, with significant growth in patient recruitment in countries such as China, South Korea, and India due to lower costs compared to developed nations. Early phase clinical trials in developing nations are notably cheaper, making them an attractive option for pharmaceutical companies. For instance, in November 2023, AstraZeneca forged a partnership with a Chinese biotechnology company to secure a position in the competitive KRAS G12D field, exchanging $24 million upfront. The agreement grants AstraZeneca a worldwide license to UA022, a small molecule inhibitor targeting the historically challenging oncogene, which was undergoing preclinical development at Usynova. The Chinese biotech, in collaboration with partners such as WuXi AppTec, spearheaded the discovery and advancement of the molecule, ultimately determining that AstraZeneca's offer, which includes potential milestone payments totalling up to $395 million, was highly compelling and thus opted to accept it.

Also, in November 2023, Novartis entered into an agreement with Chong Kun Dang Pharmaceutical, a biotechnology company based in Korea, for an early-stage HDAC6 Inhibitor. As per the contract terms, Novartis will provide an initial payment of $80 million and commit to additional development and regulatory milestone payments amounting to nearly $1.23 billion. These trends reflect a strategic shift towards countries offering lower operational expenses for clinical trials.

Challenges Posed by Lack of Comparator Sourcing

The clinical trial supplies market faces significant hurdles due to restrictions imposed by pharmaceutical manufacturers on procuring their products as comparators for clinical trials. These limitations typically encompass quantity constraints, prolonged approval procedures, and additional disclosure requirements, posing challenges for researchers and clinical trial supply chain management. Biologics, in particular, accentuate these difficulties as the lack of internal protocols and procedures from manufacturers exacerbates the situation.

Story continues

For instance, Sharp Clinical Services specializes in offering solutions for clinical trial supply chains, with a focus on comparator sourcing and supply. They cater to pharmaceutical companies conducting clinical trials, aiming to streamline the procurement process. Such firms play a pivotal role in addressing the challenges linked to comparator sourcing, thereby enhancing the efficiency of the clinical trial supply chain. Pharmaceutical manufacturers often impose strict quantity limits on procuring their products for use as comparators in clinical trials. Additionally, obtaining approval for these products can be time-consuming.

Key Market Dynamics

Market Driving Factors

Growing Decentralisation of Clinical Trials

Increasing Number of Clinical Trials

Rising Demand for Biologics Propelling Growth of Cold Chain Distribution Supplies

Integration of Technical Solutions

Increasing Investments in the Development of Novel Pharmaceuticals

Technology Advancements are Propelling Market Expansion

Market Restraining Factors

Unavailability of Storage Facilities

Lack of Comparator Sourcing

High Costs Associated with Drug Developments

Market Opportunities

Emerging Economies Expansion and Prioritisation of R&D

Increasing Opportunities for Emerging Markets

Reduction in Clinical Trials Cost by using Supply Chain is Expected to Propel Market Growth

Collaboration and Partnerships among Clinical Trial Supplies Companies

Forecasts to 2034 and other analyses reveal commercial prospects

In addition to revenue forecasting to 2034, this new study provides you with recent results, growth rates, and market shares.

You will find original analyses, with business outlooks and developments.

Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), cost structure, impact of rising clinical trial supplies prices and recent developments.

Segments Covered in the Report

Location

Offshore Clinical Site

Domestic Clinical Site

Type

Small Molecule Products

Biologic Products

Medical Devices

Services

Therapeutic Areas

Phase

Phase I

Phase II

Phase III

Phase IV

End-users

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for five regional and 22 leading national markets.

The report also includes profiles and for some of the leading companies in the Clinical Trial Supplies Market, 2024 to 2034, with a focus on this segment of these companies' operations.

Leading companies profiled in the report

Biocair

Bionical Limited

Catalent Inc.

Eurofins Scientific

ICON plc

IQVIA Holdings

KLIFO

Lonza Group

Marken

Parexel

PCI Pharma Services

Sharp Services

Thermo Fisher Scientific

Walden Group SAS

The report provides you with the following knowledge:

Revenue forecasts to 2034 for Clinical Trial Supplies Market, 2024 to 2034, with forecasts for location, type, services, therapeutic areas, phase, and end-users, each forecast at a global and regional level - discover the industry's prospects, finding the most lucrative places for investments and revenues.

Revenue forecasts to 2034 for five regional and 22 key national markets - See forecasts for the Clinical Trial Supplies Market, 2024 to 2034 market in North America, Europe, Asia Pacific, Latin America, and MEA. Also includes forecast for the market in the U.S., Canada, Mexico, Brazil, Germany, France, UK, Italy, China, India, Japan, and Australia among other prominent economies.

Prospects for established firms and those seeking to enter the market - including company profiles for 14 of the major companies involved in the Clinical Trial Supplies Market, 2024 to 2034.

For more information about this report visit https://www.Researchandmarkets.Com/r/uw1bhq

About ResearchAndMarkets.ComResearchAndMarkets.Com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

CONTACT: CONTACT: ResearchAndMarkets.Com Laura Wood,Senior Press Manager press@researchandmarkets.Com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900Breaking Down Barriers To Pancreatic Cancer Research: Two New Publications Highlight PanCAN's Work

' + '' + data[1].Title.Rendered + '' + '' + '' + moment(data[1].Date).Format('MMMM DD, YYYY') + '' + data[1].Excerpt.Rendered.Replace(/(]+)>)/gi, '').Replace(/Read More/gi, '').Substring(0, 85) + ' Read More

' + '' + '' + data[2].Title.Rendered + '' + '' + '' + moment(data[2].Date).Format('MMMM DD, YYYY') + '' + data[2].Excerpt.Rendered.Replace(/(]+)>)/gi, '').Replace(/Read More/gi, '').Substring(0, 85) + ' Read More

' + 'Medigene AG Reports Full-Year 2023 Financial Results And Provides Corporate Update

Planegg/Martinsried, March 28, 2024.Medigene AG (Medigene or the "Company", FSE: MDG1, Prime Standard), an immuno-oncology platform company focusing on the discovery and development of T cell immunotherapies for solid tumors, today reported financial results for the fiscal year ended December 31, 2023, and provided a corporate update.

Select FY 2023 financial results

Revenues amounted to EUR 6.0 million, a decrease of 81% (or EUR 25.2 million) compared to EUR 31.2 million in 2022. Higher revenues in 2022 were due to the comprehensive TCR-T and technology partnership with BioNTech concluded in February 2022, resulting in EUR 20.9 million in product revenues. In addition, revenues from the partnerships with 2seventy bio and Hongsheng Sciences were generated in 2022.

Selling expenses decreased from EUR 2.2 million in 2022 to EUR 20 thousand in 2023. This decrease is due to the above-mentioned partnership with BioNTech and the related costs incurred in the first half of 2022 as part of the preparation process leading up to the agreement.

General and administrative (G&A) expenses were EUR 9.3 million in 2023 compared to EUR 7.7 million in the year prior. This 21% increase was mainly due to higher personnel and consulting expenses as the Company supported its strategic efforts to advance all scientific and partnering activities.

Research and development (R&D) expenses decreased by 59% to EUR 11.5 million (2022: EUR 28.5 million) and reflect the work associated with the development of T cells for the treatment of solid tumors and pre-clinical development activities. The significant decrease in 2023 is mainly due to depreciation related to the full impairment of the drug candidate RhuDex®, out-licensed to Dr. Falk Pharma GmbH for the amount of EUR 20.4 million in 2022. R&D expenses incurred in the collaborations with partner companies are reimbursed by the companies. The reimbursements are recognized as R&D payments in immunotherapies revenue.

Net loss for fiscal 2023 increased to EUR 16.2 million compared to EUR 8.3 million in 2022. The increase is due to the described partnership with BioNTech in February 2022 and the associated revenues.

Cash and cash equivalents amounted to EUR 8.7 million and time deposits for EUR 8 million, totaling EUR 16.7 million on Dec 31, 2023 (Dec 31, 2022: EUR 33.2 million), with a cash runway extended into April 2025 (previously Q1 2025).

"2023 was a highly productive year for Medigene. We have made significant progress in broadening our pipeline into TCR-T therapies targeting KRAS mutations, which represent one of the most frequent neoantigens in solid cancers. We significantly advanced our End-to-End (E2E) Platform, adding new technologies such as the CD40L-CD28 costimulatory switch protein, and with a focus on improving our drug product composition to enable better efficacy, safety and durability. This was reflected by an increase in the size and scope of our patent portfolio," said Selwyn Ho, Chief Executive Officer of Medigene. "Importantly, we advanced our lead program MDG1015 towards a first-in-human clinical trial, which is expected by the end of 2024 subject to financing. This first-in-human trial will target patients with gastric cancer, ovarian cancer, myxoid/round cell liposarcoma and synovial sarcoma as the initial clinical indications."

"In 2024, we will continue to advance our differentiated TCR-T therapies for the treatment of solid tumors. Using our core expertise and ability to generate optimal TCRs, we will also aim to apply these to new TCR-based modalities beyond TCR-T cell therapies, such as off-the shelf T cell engagers and allogeneic TCR-Natural Killer cells, where further value could be created for patients and our shareholders. We believe that these additional potential therapeutic options represent highly promising commercial opportunities for Medigene."

Financial Guidance 2024

The 2024 financial projections include potential future milestone payments from existing partnerships that are highly likely to materialize in the amount of USD 1 million and EUR 2 million, respectively. They do not include potential milestone payments from or future/new partnerships or new transactions as the occurrence of such payments or their timing and size largely depend on third parties and cannot be controlled or influenced by Medigene.

As such, the 2024 financial guidance reflects the Company's focus and progress in its core immunotherapies business.

Based on the above assumptions, Medigene expects revenue in 2024 to be between EUR 9 and 11 million. The Company expects R&D costs to range from EUR 11 to 13 million. And as already mentioned, based on current planning, the Company is funded into April 2025.

Program development highlights

MDG1015: MDG1015 is a first-in-class, third generation T cell receptor engineered T cell (TCR-T) therapy targeting NY-ESO-1/LAGE-1a (New York esophageal squamous cell carcinoma 1 / L Antigen Family Member-1a), armored and enhanced by the costimulatory switch protein PD1-41BB and targeting HLA-A*02 (HLA, human leukocyte antigen). Preclinical data presented in 2023 at the AACR and ESMO conferences demonstrated the clear potential of MDG1015 to improve clinical outcomes in solid tumors.

Following recent positive EU and US preliminary regulatory interactions, the Company remains on track for an IND/CTA approval in the second half of 2024. Subject to financing, the Company expects to initiate a first in-human trial for MDG1015 by the end of 2024.

MDG2011: MDG2011 is a potential best-in-class third generation TCR-T therapy targeting KRAS G12V (HLA-A*11), further armored and enhanced by the PD1-41BB costimulatory switch protein. First pre-clinical data on MDG2011 was presented at the ESMO Congress 2023 and the SITC Annual Meeting 2023. Lead selection for MDG2011 was announced in the third quarter 2023.

MDG2021 and MDG2012: MDG2021 is our second candidate within the KRAS library targeting KRAS G12D (HLA-A*11) with lead selection expected in the first half of 2024. The lead selection for the Company's third announced KRAS-targeted program MDG2012, KRAS G12V (HLA-A*03), is expected in 2025.

Corporate development highlights

To support the development of our research projects, we have established a partnership network with both, well-known biotechs and renowned academic bodies.

In April 2023, Medigene entered into a joint collaboration with the US National Cancer Institute to assess the potential of Medigene's proprietary TCRs for use in new cell constructs in the treatment of solid tumors.

The Company's existing partnerships with BioNTech and 2seventy bio are progressing well.

In January 2023, Medigene received a USD 3 million milestone payment from its partner 2seventy bio triggered by 2seventy bio's initiation of a strategic partnership with JW Therapeutics in December 2022.

Expansion of patent portfolio

The advancement of its E2E Platform allowed the Company to extend and strengthen its patent portfolio with new technologies as well as to expand existing patents into additional jurisdictions, such as the costimulatory switch proteins for use in multiple cell types and their geographical coverage. As of Dec 31, 2023, Medigene's IP portfolio consisted of 112 issued and 131 pending patents across 28 patent families.

Conference Call and Webcast

The Company will host a conference call and webcast today at 3 pm CET / 10 am ET. A Q&A session will follow the management's formal presentation.

Full details for the conference call and webcast are as follows:

Date March 28, 2024 Time 3:00 p.M. CET (10 a.M. ET) Conference ID: 20240088 Registration Conference Call: Registration Conference Call here Webcast: Join the live webcast hereParticipants may pre-register and will receive dedicated dial-in details to easily and quickly access the call with the above registration link for the conference call.

Please dial in 10 minutes ahead of time to ensure a timely start of the conference call.

Following the call, an archived webcast will be accessible on the Investors & Media section of the Medigene website: https://www.Medigene.Com/investors-media/reports-presentations

--- end of press release ---

About Medigene AGMedigene AG (FSE: MDG1) is an immuno-oncology platform company dedicated to developing differentiated T cell therapies for treatment of solid tumors. Its End-to-End Platform is built on multiple proprietary and exclusive technologies that enable the Company to generate optimal T cell receptors against both cancer testis antigens and neoantigens, armor and enhance these T cell receptor engineered (TCR) -T cells to create best-in-class, differentiated TCR-T therapies, and optimize the drug product composition for safety, efficacy and durability. The End-to-End Platform provides product candidates for both its own therapeutics pipeline and partnering. Medigene's lead TCR-T program MDG1015 is expected to receive IND/CTA approval in the second half of 2024. For more information, please visit https://medigene.Com/This press release contains forward-looking statements representing the opinion of Medigene as of the date of this release. The actual results achieved by Medigene may differ significantly from the forward-looking statements made herein. Medigene is not bound to update any of these forward-looking statements. Medigene® is a registered trademark of Medigene AG. This trademark may be owned or licensed in select locations only.

Medigene AG

Pamela KeckPhone: +49 89 2000 3333 01E-mail: investor@medigene.Com

In case you no longer wish to receive any information about Medigene, please inform us by e-mail (investor@medigene.Com). We will then delete your address from our distribution list.

Comments

Post a Comment